With high inflation, the Federal Reserve raising interest rates, and the economy contracting for two consecutive quarters, the possibility of a recession doesn’t seem far-fetched.

Contrast that with a strong dollar, job market, and resilient corporate and personal spending, and there is room for debate.

What do we know? Economists are notoriously bad at predicting recessions, and typically a recession isn’t technically declared until many months or even years after it actually started. There’s a possibility we are already in one now.

While it’s difficult to say for certain “are we or aren’t we,” here are 4 things you should know.

1. What is a recession?

For something with as many tentacles and implications, you’d think we’d have a pretty solid definition of “recession” by now. Spoiler alert: we don’t. In fact, there is no precise definition. Instead, it’s up to the National Bureau of Economic Research, a nonprofit academic group, to determine. On its website, NBER defines a recession as “a significant decline in economic activity that is spread across the economy and lasts more than a few months.”

It sounds straightforward in theory but is much more nuanced in practice.

Take COVID. NBER declared the start of COVID as a recession even though it lasted only a few months. The NBER academic committee considers a range of economic data and typically makes the determination months or even years after a recession ends. It’s entirely possible that a short recession could be over before it’s officially declared.

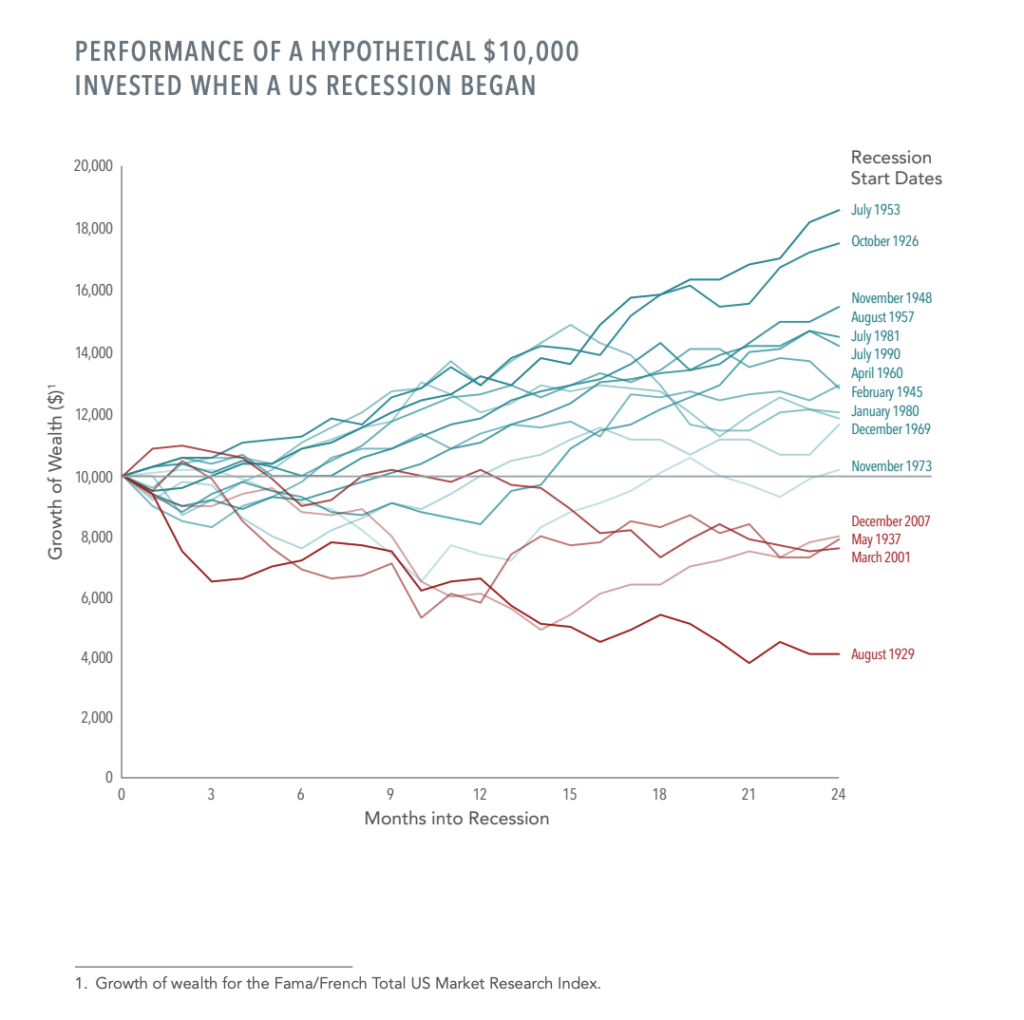

While few people are excited about the prospect of entering a recession, they are a normal part of our economic cycle. From a historical perspective, there have been 15 recessions in the last 100 years, and they’ve lasted an average of 17 months. In about 70% of those instances, stock returns were positive two years after the recession began.

Source: Dimensional Fund Advisors. Past performance is no guarantee of future results. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment.

2. What should people be doing right now to prepare for a recession? Is there a specific list of financial goals to follow?

The saying “cash is queen” bodes true for many during a recession. We customize the amount of liquidity recommended to clients based on their personal circumstances.

Are you contemplating entrepreneurship? Run some projections on what it could take to make the leap and be proactive. Extra cash and liquidity makes a lot of sense here.

If you’re in a highly paid specialized position and replacing your income could take longer if you lose your job, consider a backup to your emergency fund. A home equity line of credit could make sense for you, and it’s best to obtain it while still employed.

Also, think about your job and how your role or company might be impacted by a recession. If you feel there is risk you might be laid off, you may need more money set aside than standard rules of thumb like 3-6 months.

Lastly, don’t panic. The job market has continued to be strong and there are some signs that inflation may be cooling off. What you shouldn’t do is make moves based on recessionary fears, as recessions don’t last forever.

3. Are there smart investments people can be making right now?

It’s important to remember that markets are forward looking, and oftentimes they react before investors even know we are in a recession. This could explain what we saw in roughly the first half of the year when markets were down 20%. They made a nice recovery in July, which could be a signal that the risk of a recession isn’t as great as markets once thought.

Another way to think about this question is what not to do:

- Don’t try and time the market; the data just doesn’t back it up and it’s exceptionally difficult to do, even for professionals.

- Don’t fall for ‘get rich quick’ fads – while it might be tempting to try to get rich off the next GameStop or Tesla, the best approach to building wealth is to invest in low cost index funds that invest broadly in companies here in the U.S. and around the globe.

Good investing doesn’t have to be sexy or overly complicated. Downturns and volatility are part of investing–it’s normal for your portfolio to be down every 4 or so years. As a long term investor, it’s a bit easier to shift your view and see this period of time as an opportunity.

Regardless of what the market is doing, it’s a good idea to pay yourself first via a retirement plan or brokerage account. Investing in yourself by enhancing your health, relationships, personal and professional fulfillment and growth will always be in style and pay some of the highest returns.

4. If someone does get laid off, what are key financial tasks they should take care of right away?

Layoffs are not easy. Some friends and clients in the tech space have experienced this lately, and we certainly feel for them.

One of the first things to consider is medical coverage. Prior employer coverage can extend via COBRA, switching to a partner or spouse’s plan, or enrolling in the state’s insurance marketplace. Being laid off counts as a “qualifying event,” which means you can enroll in a private health plan outside the normal open enrollment window. Additionally, if you will have lower expected household income for the year you need coverage, it’s worth looking into the premium tax credit.

Evaluate your options with your workplace retirement account. You can usually just keep your money in the same plan, roll it over to a new employer’s plan, or roll it into an IRA or Roth IRA for after-tax contributions. Take a look at your old plan’s investment options to see if low-cost index funds are available. You’ll also want to look at the fees you’d pay to keep your money in the 401k plan — there is no need to pay high fees to get access to quality funds. Also, where is the rest of your money? Is it necessary to have it spread across multiple accounts? How can you simplify? Are you being as tax efficient as you can?

Assess the benefits you may no longer have and evaluate what your options are now. Do you have a life insurance policy independent of an employer? Do you have unused Flexible Spending Accounts or Health Savings Account funds? Make sure you find out what happens once you are no longer an employee. Also, double check your last payroll statement with your account balances. Get paid out for vacation, sick time, and file for unemployment.

Keep Calm and Carry On

While the uncertainty surrounding recession, continued inflation, and potential job layoffs can be stressful, the most important thing to do is not panic. Building a solid emergency fund, investing wisely, and creating a plan unique to your personal situation is the best approach to weathering whatever future storms we may face.

If you’re not sure where to start, or whether the plan you have in place is solid, reach out to us – we’re here to help.

Uplevel Wealth is a fee-only, fiduciary wealth management firm serving clients in Portland, OR and virtually throughout the U.S.