As we close out the year, you’ve probably noticed that the stock market’s been on a bit of a wild ride. Markets dropped sharply on Black Friday as news of the omicron variant emerged and have continued to seesaw as markets try to decipher how this new development will impact travel, consumer spending, interest rates, and more.

These swings have caught many investors off guard after 18 months of strong market returns. If you’re one of them, read on for three tips to survive stock market volatility:

1. Worrying is normal. Most of us have complex emotions surrounding money and investing, and it’s especially common to feel concern when the money we’ve worked so hard to earn and save may be at risk. Our brain’s “fight or flight” reaction, which served us well in the days of animal predators, often leads to panic when the news appears bad or our investment portfolio takes a downturn.

Instead of the sabre-toothed tiger, many investors fall prey to common behavioral biases like loss aversion and anchoring, two phenomena popularized by economist and Nobel Prize winner Richard Thaler. His study of loss aversion showed that people feel the pain of losses twice as acutely as the pleasure of wins, meaning a day in which your portfolio falls two percent, for example, likely feels much more traumatic than the happiness experienced on a day in which your portfolio rises by the same amount.

Another common cognitive bias is the concept of anchoring, which occurs when we have a particular value or number in mind. Perhaps you reached a milestone in the balance of your investment portfolio, only to see it slip backwards during this most recent volatility. That decline may feel like a “loss,” even though your portfolio is still likely higher than it was a year ago.

The temptation to react in stressful times and “do something” is a very human behavior. The best thing we can do as investors is remind ourselves that choosing to “do nothing” and sticking with the long-term plan is also taking action.

2. Have a little perspective. While we all enjoy seeing positive returns and growing portfolios, the less pleasant reality of investing is that markets are volatile in the short term.

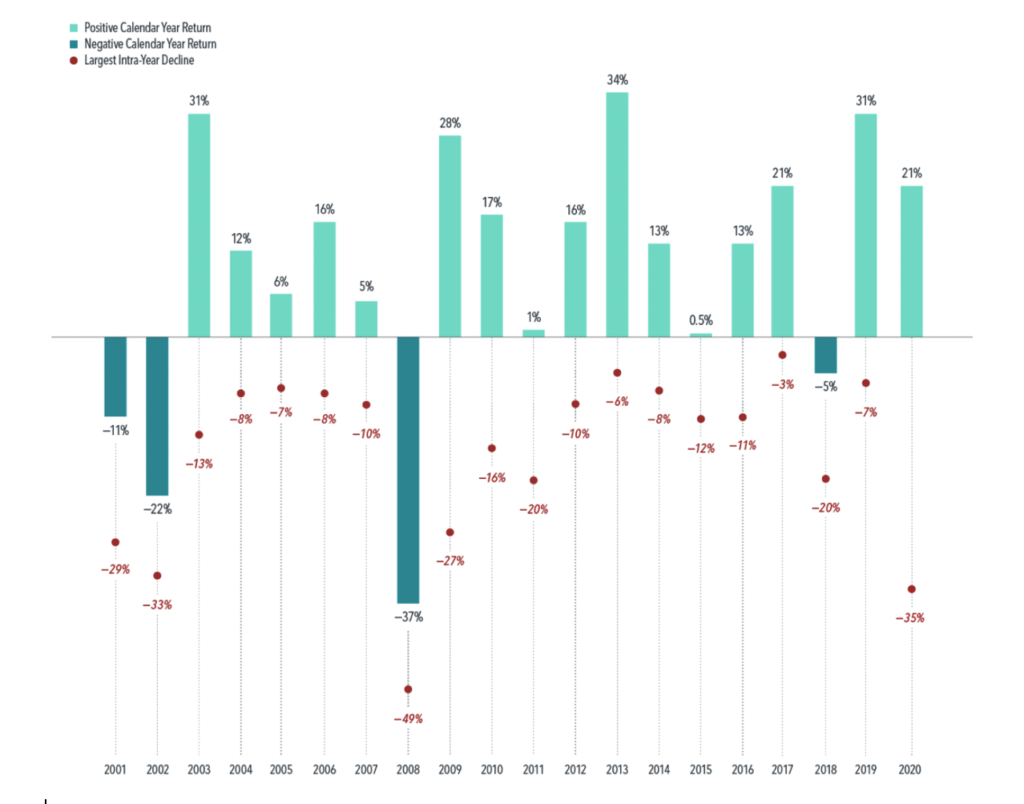

It’s not uncommon to experience a market correction, which is a decline from a previous peak of 10%, or a bear market, which is a decline of 20%, in any given year. In fact, even years with positive stock market returns experience intra-year declines. Looking back at the past 20 years, the US stock market had positive returns in 16 of those years, despite intra-year declines ranging from 3% to 49%.

US Market Intra-Year Declines vs. Calendar Year Returns, January 2001 – December 2020

Chart courtesy Dimensional Fund Advisors. January 2001–December 2020, in US dollars. Data is calculated off rounded daily returns. US Market is represented by the Russell 3000 Index. Largest Intra-Year Decline refers to the largest market decrease from peak to trough during the year. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful. Past performance is not a guarantee of future results.

While we don’t know how 2021 will end, investors have enjoyed another year of strong returns, despite recent volatility. US stocks, represented by the Russell 3000 Index, have returned over 24% year to date, well above historical averages. International stocks, represented by the MSCI All Country World Index Ex-US haven’t fared quite as well, but have still enjoyed returns north of 7% year to date.

As unpleasant as volatility can be, it’s a normal part of investing. Having a long-term focus and a little perspective can help us all get through the inevitable tumbles along the way.

3. Take a look at how your portfolio is allocated. If stock market volatility is causing you to lose sleep, perhaps that’s a sign it’s time to revisit your asset allocation, or mix between stocks and bonds.

A healthy allocation towards stocks is needed for most long-term investors, especially to keep pace with inflation like we’re seeing today. Stocks also experience greater volatility than safe government bonds like US Treasurys. If fluctuations in your portfolio are a cause of great concern, that may be a sign that a permanent shift to a more conservative portfolio is due.

The right asset allocation is unique to each investor and depends on a number of factors. At Uplevel Wealth, we like to say that choosing the mix between stocks and bonds is as much art as science. While ensuring our clients have enough growth via stocks to achieve their future goals, equally important is creating a portfolio mix they can stick with in good times and bad.

Having a comfortable cushion of cash for emergencies or access to low interest rate funds like a home equity line of credit (HELOC) is also a vital part of a healthy investment plan. As mentioned earlier, market volatility is nothing unusual. What investors should avoid is being forced to sell investments for cash needs at the same time markets are struggling.

Lastly, do your best to tune out the noise. Whether it’s the news, social media, or your brother-in-law at the holiday get together, remember that nothing grabs our attention like scary headlines. If you find yourself worrying about recent volatility, a good first step is to take a much-needed break from the “noise.” Read a book, take a walk, or turn on some cheerful holiday music.

Or, give us a call at Uplevel. We’re here to help.