Last week, the Federal Reserve met and kept rates unchanged with a target range of 5.25% to 5.5%. Despite investors anticipating this, markets responded negatively. Issues including a possible government shutdown, cracks in China’s economy, higher oil prices, and more continue to cause uncertainty.

Here are three things we’re thinking about to maintain perspective on the state of the economy.

- Communication has evolved

Many investors are concerned the Fed will keep rates too high for too long, as indicated by “forward guidance.”

Forward Guidance refers to the expectations the Fed sets through its communications, which have evolved significantly over the past three decades. Consider the following:

- During the Greenspan era of the mid-1980s to mid-2000s, Fed decisions were typically made with simple written statements, often only a few short paragraphs.

- Beginning in 2011 with Ben Bernanke, the Fed began holding quarterly press conferences and publishing its Summary of Economic Projections.

- During Janet Yuellen’s tenure, further changes were made to expand the Fed’s forward guidance and clarify the expected path of rates.

Today, under Jerome Powell, the Fed Chair now hosts a press conference after every meeting, even when there is no change in the fed funds rate. This is in addition to the numerous other speeches and written pieces by the Fed Chair and other Fed officials.

The Fed’s use of forward guidance means that rate decisions are often telegraphed well in advance, resulting in few surprises. The market’s reaction is often more in response to the press conference and the Summary of Economic Projections.

2. Stronger Economic Conditions

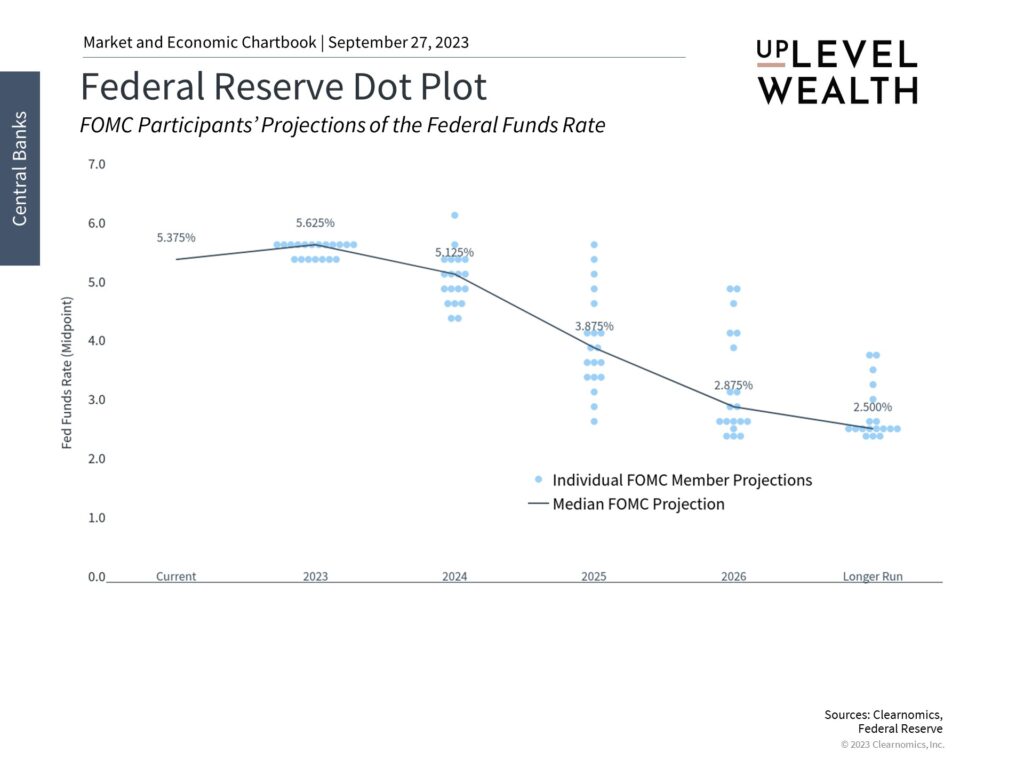

The Fed’s latest projections show that it expects to raise rates one more time in 2023.

The Fed revised its forecasts to reflect a much stronger economy, with expected GDP growth this year shifting from 1.0% to 2.1% and the unemployment rate falling from 4.1% to 3.8%.

Perhaps most importantly for market expectations, the FOMC’s estimate of future policy rates also jumped in response to these stronger economic conditions. Rather than the fed funds rate falling to 4.6% and 3.4% by the end of 2024 and 2025, respectively, the committee now believes rates will stay higher at 5.1% and 3.9%.

3. Planning for the Unknown

Investors, of course, are worried about many other issues beyond the Fed. This is nothing new – the endless stream of headlines always contains reasons for investors to be fearful of the market. Although stock and bond prices have pulled back in the third quarter, year-to-date gains are still quite strong by historical standards. This shows that it is difficult to predict what the market may do next.

Ultimately, what drives returns for investors are not individual Fed decisions or economic data releases but the longer-term trends in the economy and markets. It’s important to stay disciplined and remember that conditions today are far better than investors could have hoped for a year ago.

What does this mean for you?

The past year’s events (and every year) remind us that the economy consists of thousands of interconnected parts. Adjusting one, such as the Fed has with interest rates, can have ripple effects that are impossible to predict.

Rather than making adjustments based on what might happen, which will inevitably be wrong, we instead build financial plans that consider a wide variety of scenarios while still leaving our clients a wide “moat” for the unforeseen.

We’d love to show you how we can do the same for your family. Reach out, we’re here to help.

Uplevel Wealth is a fee-only, fiduciary wealth management firm serving clients in Portland, OR, and virtually throughout the U.S.