As climate change disasters such as wildfires, floods, and intensifying storms seem to be increasingly common, many people are looking for a way to encourage companies to enact positive change, while casting a “vote” against the worst offenders. Enter the world of sustainable investing options, which have steadily grown in popularity over the last decade.

According to Barron’s, U.S. ESG mutual fund and ETF assets have soared to a record $400 billion in 2021, up 33% from the year before. Despite this strong growth, the overall market share is still small, at just 1.4% of total U.S. mutual fund and ETF assets.

With the huge market potential, it’s hard to know where to start. Here are three things we have incorporated in building a sustainable investment option for Uplevel clients.

Prioritize and Focus

There is no one true, universal definition of ethical investing. This is why it can be so confusing to understand and interpret. There are still many gray areas.

Environmental, Social and Governance (ESG) investing is a framework you can use within ethical investing to evaluate investments and put your money to work with companies that strive to make the world a better place. In addition to financial factors, ESG investing also considers non-financial factors to measure an investment or company’s sustainability.

Here are some of the things each category may incorporate:

|

Environmental |

Social |

Governance |

|

|

|

ESG investing relies on independent ratings that assess a company’s behavior and policies in these various categories. Currently, there is no standardized approach to these measurements. ESG metrics are also not part of a company’s mandatory financial reporting, although many companies are voluntarily making disclosures or creating standalone sustainability reports.

Designing a sustainable portfolio for Uplevel clients starts with values. We let our clients, prospective clients and combined 35+ years of experience guide us in defining the sustainable problem we are trying to solve: Climate change. Without this focus, it’s hard to have transparent reporting and results.

“If I had only one hour to save the world, I would spend fifty-five minutes defining the problem, and only five minutes finding the solution.” Likely said by a Yale professor but often attributed to Einstein.

Given our location in Portland, Oregon, it’s common to have clients who are interested in a sustainable way to invest. What we like about focusing within the “E” bucket and climate change specifically, is that we can rely on science to identify and pinpoint the primary contributor to climate change–greenhouse gas emissions. Also, the data on greenhouse gas emissions are widely available for public companies.

Look Under the Hood

It’s imperative to look beyond ESG branding when evaluating the viability and quality of various funds. Worth mentioning again is the absence of a universally accepted definition of sustainable investing, which gives way to broad interpretations and approaches to ESG investing. The components of ESG considered in an investment strategy, variables by which they are measured, and the method of incorporation can lead to a range of investment outcomes.

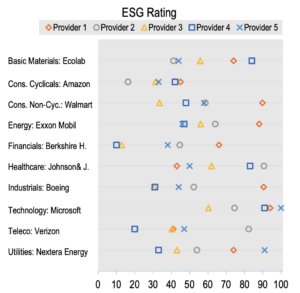

Put another way, a company’s ESG rating is very subjective and there is often a lack of focus on what’s actually being measured. Even the ratings providers themselves can’t seem to agree with one another. The OECD assessed different rating providers and found ESG scores to vary widely.

From the graph below, we can see the variability of ratings. Take Johnson & Johnson, which is given a score in the low 40s by one provider and 90 by another. Not only is this significant difference hard to decipher, but it raises important questions about reliance on any one rating and can lead investors to wonder if they are having the impact they think they are.

Source: The OECD

Rather than rely on generic, and heavily opinion-based ESG ratings for building our clients’ sustainable portfolios, we turn instead to assessing the availability, quality and objectivity of data and transparent reporting.

In our analysis, we found Dimensional Fund Advisors’ (DFA) approach to be the most robust. Their sustainability strategies are designed to have a clear focus on climate change.

The process begins by screening out the worst emitters of greenhouse gasses–including “in the air” and “in the ground” emissions–from the portfolio. DFA utilizes carbon emissions data and scales it by a company’s sales to determine how much carbon is emitted to produce a dollar of sales. This carbon emissions intensity represents 85% of the score.

DFA is mindful to not exclude certain sectors, as they all need to decarbonize. Instead, they go sector by sector and overweight the companies that are the most sustainable, and underweight the companies that are the least. This is important, as removing sectors entirely is shortsided. It takes the entire economy to run the world, and removing components would decrease the diversity of the fund.

Eventually, kicking out sectors could also leave you with an overweight of large cap technology companies. Their practices are to exclude or reweight, but not concentrate. The remaining 15% of the score screens out companies for other considerations, including palm oil, child labor, factory farming, etc.

Set and Manage Expectations

While it’s important to note there currently isn’t a known or evidenced based return premium for investing in a sustainable fashion, it also doesn’t need to cause underperformance. The evidence shows we can still own high-quality investments with returns similar to a non-ESG fund, provided we do it right and stick to sound investment principles like diversification, lost cost, low turnover, etc.

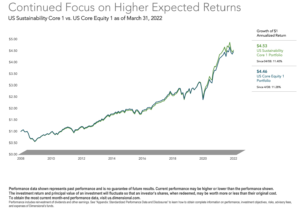

Over 13 years, this type of sustainable approach has had very similar performance to a more traditional DFA portfolio. As the data provided by DFA below demonstrates, returns of their US Sustainability Core 1 Portfolio have been remarkably similar to their “traditional” US Core Equity 1 Portfolio going back to 2008, illustrating that investing sustainably doesn’t have to mean sacrificing long-term performance.

Source: Dimensional Fund Advisors. Performance data shown represents past performance and is no guarantee of future results. Current performance may be higher or lower than the performance shown.

We also make sure clients understand that it’s imperfect to compare “traditional” portfolio performance to “sustainable” investment performance by using the same indices as benchmarks. By intentionally screening out the worst offenders from our sustainable portfolio, there will be periods of time when the portfolio deviates from the market by design.

For example, in the first quarter of 2022, the energy sector did remarkably well. Oil prices spiked to record highs due to supply chain issues and geopolitical events. Exxon Mobil Corp stock, the biggest public energy company in the world, was up over 30% year to date. At the same time, big tech companies were approaching a market correction. Given the underweight of energy companies relative to technology companies in an Uplevel sustainable portfolio, it has faced some headwinds so far this year.

Regardless, we believe long-term sustainable investors have many reasons to be optimistic about the future. Seven out of the ten largest pension funds in the world invest in sustainable funds, which will continue to pressure big corporations to make positive changes.

Additionally, the Securities and Exchange Commission just proposed new rule changes requiring companies to report their greenhouse gas emissions and details of how climate change is affecting their businesses. We’re confident markets will work better with more standardized information, and the new SEC disclosure should help drive better outcomes.

While it’s not always easy, our message remains consistent—much of investing requires taking the good with the bad. Remaining focused and disciplined, regardless of ESG strategy, is what leads towards future rewards in the long run.

Do you need help understanding sustainable investment options? Reach out to us at Upevel. We’re here to help.