Summer is in full swing, and road trips are some of the best ways to get out and explore nature and new places.

With an average of $4.65 at the pump on the west coast, gas prices aren’t the only costs you’ll encounter. Auto insurance costs rose 15% from last year, and rates will likely continue to climb.

Insurance providers can often bundle auto insurance with homeowners policies, often for a premium saving, as both are property and casualty insurance. However, understanding these contracts’ various terms and conditions can take time and effort. Deductibles, limits, exclusions, and endorsements can be hidden in the fine print, making it hard to understand the true extent of your protection.

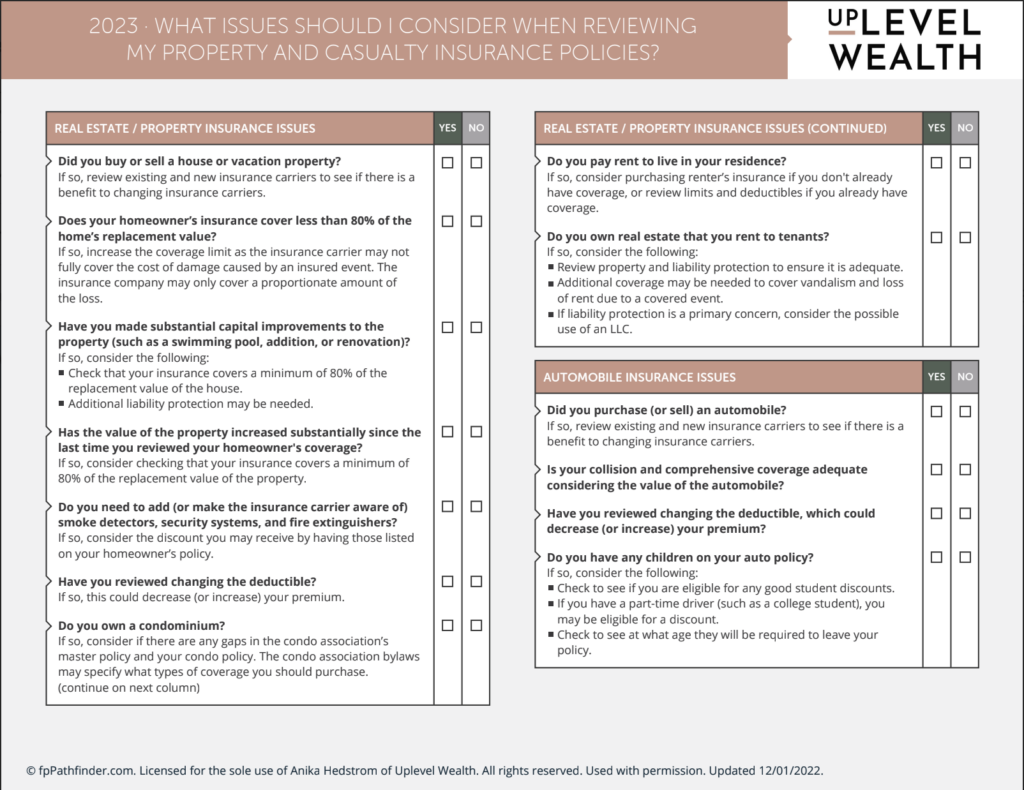

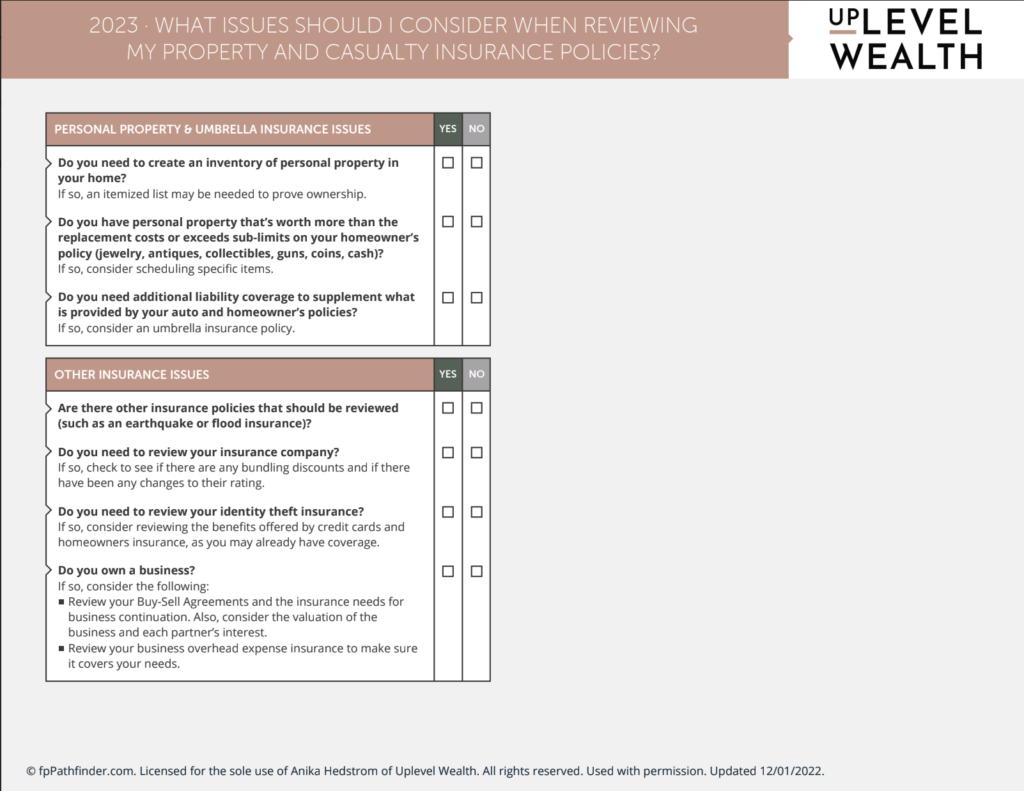

Property and casualty insurance policies are vital to your overall financial plan. An annual review of your policies is always a good idea to ensure you have the coverage you need. It is also a good exercise to identify potential gaps and areas that have changed since your last review.

To help, we’ve included an integrated checklist you can also download that outlines key considerations. While the list can help you identify opportunities to consider, we’re always available to meet with you to assist in this analysis. Please reach out; we’d love to help.

Uplevel Wealth is a fee-only, fiduciary wealth management firm serving clients in Portland, OR and virtually throughout the U.S.