As we approach the presidential election on November 5, polls show a close race between former President Donald Trump and Vice President Kamala Harris. Both candidates are working hard in key swing states, and understandably, investors may be concerned about how the results could affect their portfolios.

Given recent years of heightened political division, emotions are running high, and it’s easy to feel that these shifts could impact everything—including your finances. Yet, investors should prevent politics from derailing their long-term financial plans in such times.

As citizens, our choice in this election may impact aspects of our daily lives. Setting aside personal political views, your portfolio doesn’t need to follow suit. History shows that it’s often the markets and economy that shape election outcomes rather than the other way around. Our job as investors? Vote at the ballot box, not with our life savings.

Keeping Perspective: Elections Don’t Dictate Market Trends

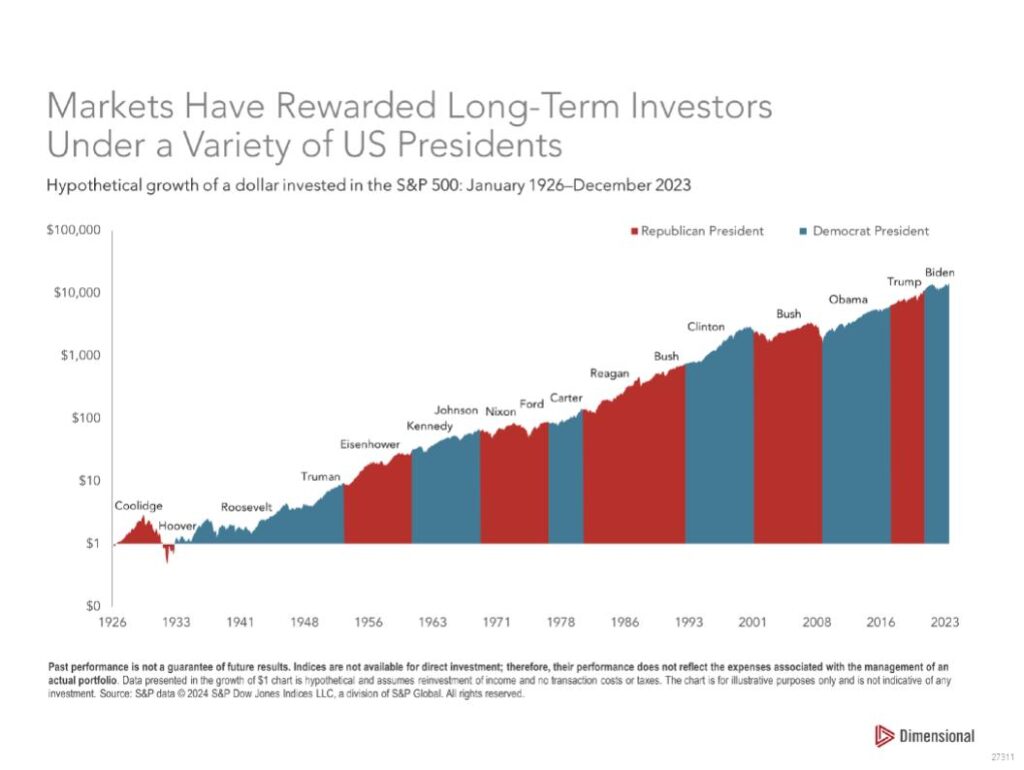

One common misconception is that presidential elections directly dictate stock market performance for years to come. While campaign rhetoric may create some volatility, the stock market’s long-term resilience has been proven across different administrations. Looking back over the past century, the market has generally performed well regardless of which party held the presidency.

While short-term market fluctuations might occur after the election, the big picture remains steady: economic fundamentals, not political shifts, drive the long-term market outlook.

Navigating Tax Policy Uncertainty

Of course, this election does bring some areas of uncertainty—tax policy is a notable example. With the Tax Cuts and Jobs Act (TCJA) set to expire at the end of 2025, future tax rates are unclear, creating what some call a “tax cliff.” Both candidates have different proposals, especially regarding corporate and individual tax rates, capital gains, and estate planning.

While it’s natural to feel apprehensive about potential tax changes, tax policy is just one factor influencing the economy and markets. Our federal tax rates are near historic lows, whether the top marginal rate is 37% or 39.6%, and planning for a rise in tax rates down the road is part of any sound financial strategy.

Estate taxes might be an area to watch closely for higher-net-worth households. Thanks to the TCJA, the estate tax exemption stands at $13.6 million per person in 2024. If Congress doesn’t act, this could revert to the pre-TCJA level, adjusted for inflation, which economists believe would be approximately $6.8 million per individual in 2026.

Trade Policy: What to Expect

Another area to watch is trade policy. The candidates’ approaches to trade and tariffs differ, particularly regarding U.S. competitiveness and reshoring manufacturing. While trade dynamics may evolve, it’s worth noting that fears of a “trade war” in recent years didn’t materialize in the way some predicted. Despite some tariffs, the economy remained strong, with low unemployment and inflation even as late as 2019.

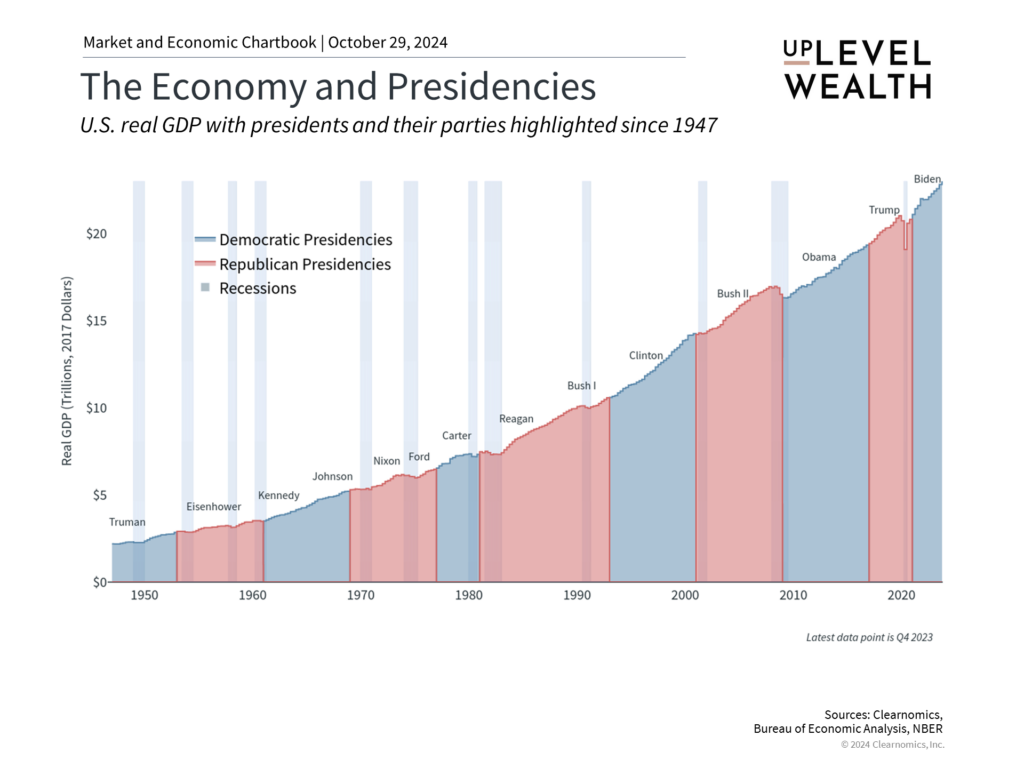

The Bigger Picture: The Economy Has Thrived Under Both Parties

Over time, economic growth has persisted across different administrations. Market cycles and trends—such as the rise of technology and the expansion of artificial intelligence—drive growth far more than shifts in political leadership. And thanks to checks and balances in our political system, policy changes tend to be gradual, providing stability to investors.

Looking at tax policy, neither candidate is proposing a return to pre-1980s rates. When it comes to trade, while tariffs might shift, they are unlikely to return to the high levels of the early 20th century. Keeping this context in mind can help us avoid letting fear overshadow facts in our planning.

The Takeaway

As this election approaches, remember that while it has implications for our daily lives, its direct impact on your long-term financial outlook is likely smaller than it seems. The economy has grown steadily under both parties, and history shows us that the market endures, regardless of who’s in the White House.

At Uplevel Wealth, we’re here to help you keep perspective, stay focused on your goals, and navigate any changes ahead. Contact us and schedule an introductory call. We’re here to help.

Uplevel Wealth is a fee-only, fiduciary wealth management firm serving clients in Portland, OR, and virtually throughout the U.S.