The Federal Reserve’s interest rate decisions remain a focal point for markets. While the timing and size of rate cuts are the subject of debate, why the central bank is cutting rates and how the full rate cut cycle might play out are far more important.

The implications are not as straightforward as they seem, and market expectations have shifted dramatically over the past year.

What should investors know about how rate cuts have historically impacted the economy and markets?

The Fed lowers interest rates to stimulate the economy by making borrowing cheaper and encouraging spending, especially during downturns like the dotcom bust, 2008 financial crisis, and the 2020 pandemic. Although rate cuts aim to boost growth, they often coincide with recessions and bear markets, leading to poor returns. Conversely, though intended to slow the economy, rate hikes often occur during booms and can be linked with strong market performance.

The Fed is not battling a sudden economic collapse or financial crisis today. Instead, it is navigating a period of steady but slowing growth, improving inflation, and a weakening but still strong labor market.

In other words, the current situation is quite different from periods of emergency rate cuts. This is why the rationale for lowering rates matters when considering how they might impact markets in the months and years ahead.

Perhaps a more applicable example is the 1994-1996 rate cycle, when the Fed raised rates to combat inflation fears before lowering them again shortly after that. Periods like these are often called “soft landings” since the Fed arguably managed to cool the economy without triggering a recession. While there was a significant shock to the bond market – just as in 2022 – markets eventually responded positively to rate cuts once the economy stabilized.

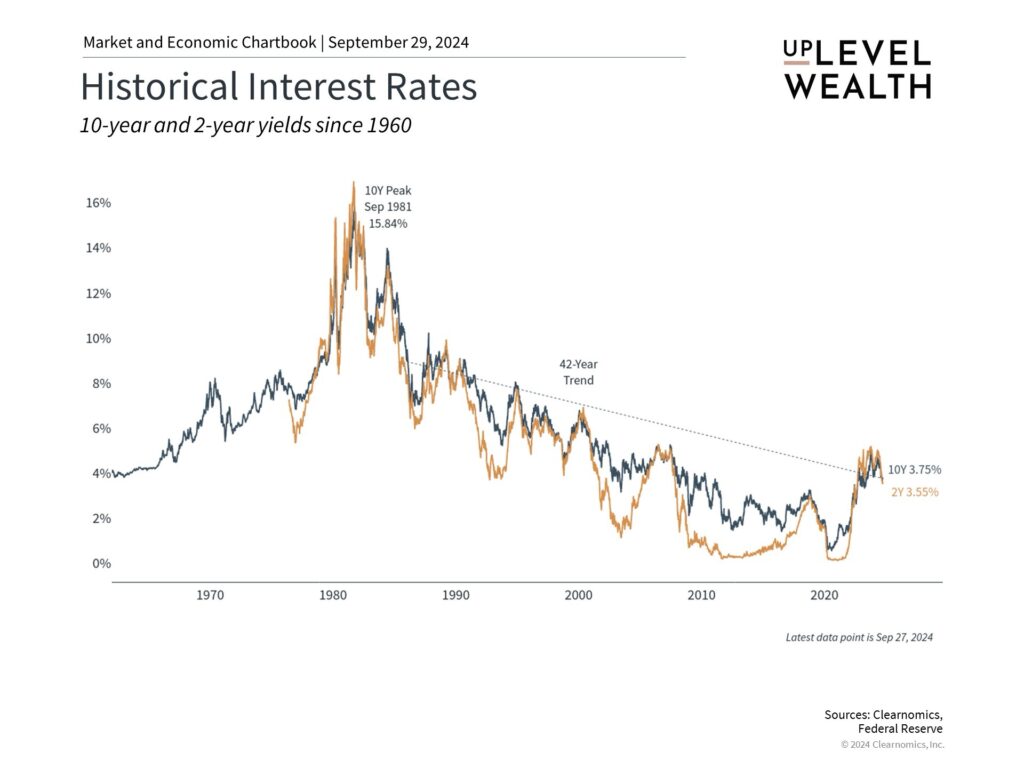

While the past is no guarantee of the future, lower rates have been positive for both stocks and bonds across history. Bond prices, in particular, move in the opposite direction of bond yields, which is why many bond indices have rebounded in recent weeks.

For stocks, lower interest rates mean businesses have access to cheaper financing for investment and expansion. When it comes to the math of valuing companies, lower rates mean that future cash flows are discounted less, which can result in more attractive prices today. Of course, the market never moves up in a straight line, and investors should always be prepared for periods of volatility as the financial system adjusts to Fed moves.

As we enter a new phase of monetary policy, economists will closely monitor these indicators, particularly those related to employment and growth. The Fed’s challenge will be calibrating its policy response to support the economy without reigniting inflationary pressures or creating imbalances in financial markets.

The key takeaway?

Understanding why the Fed cuts rates is as important as the cuts themselves. Instead of getting caught up in short-term moves, stay focused on the bigger picture and keep your financial goals in mind for the long haul.

Do you have questions about your portfolio and how interest rates may impact it? Contact us and schedule an introductory call. We’re here to help.

Uplevel Wealth is a fee-only, fiduciary wealth management firm serving clients in Portland, OR, and virtually throughout the U.S.