The 19th-century author Balzac wrote, “Our worst misfortunes never happen, and most miseries lie in anticipation.”

Yet, as we approach the end of the year, many of the miseries that investors feared did not take place. Instead, the S&P 500 is near record levels, inflation is subsiding, the economy is growing steadily, and the Fed has begun to cut interest rates. This is a reminder that excessive worry can lead investors to make decisions that may not serve their long-term interests.

If the past few years have been about extremes – the bear markets of 2020 and 2022, compared to the sharp rebounds in 2021, 2023, and 2024 – then 2025 should be about regaining balance. This is as much about investor emotion as the economic data.

History shows that those who maintain a disciplined, long-term approach are better positioned to achieve financial success. This will only grow in importance in the coming year. Stock market valuations are well above average, interest rates are uncertain, doubts about artificial intelligence are emerging, and geopolitical risks are escalating. There will likely be many more unforeseen events that will heighten investor concerns.

Fortunately, the past year’s lessons can guide financial decisions in 2025 and beyond. Below, we present five important insights that can give investors perspective even when the world seems uncertain and other investors fear the worst.

1. The economy is doing better than expected

Despite worries about high interest rates hurting the economy, things have turned out well. Prices in stores aren’t rising as fast as before, jobs are plentiful with unemployment at just 4.2%, and the economy is growing steadily.

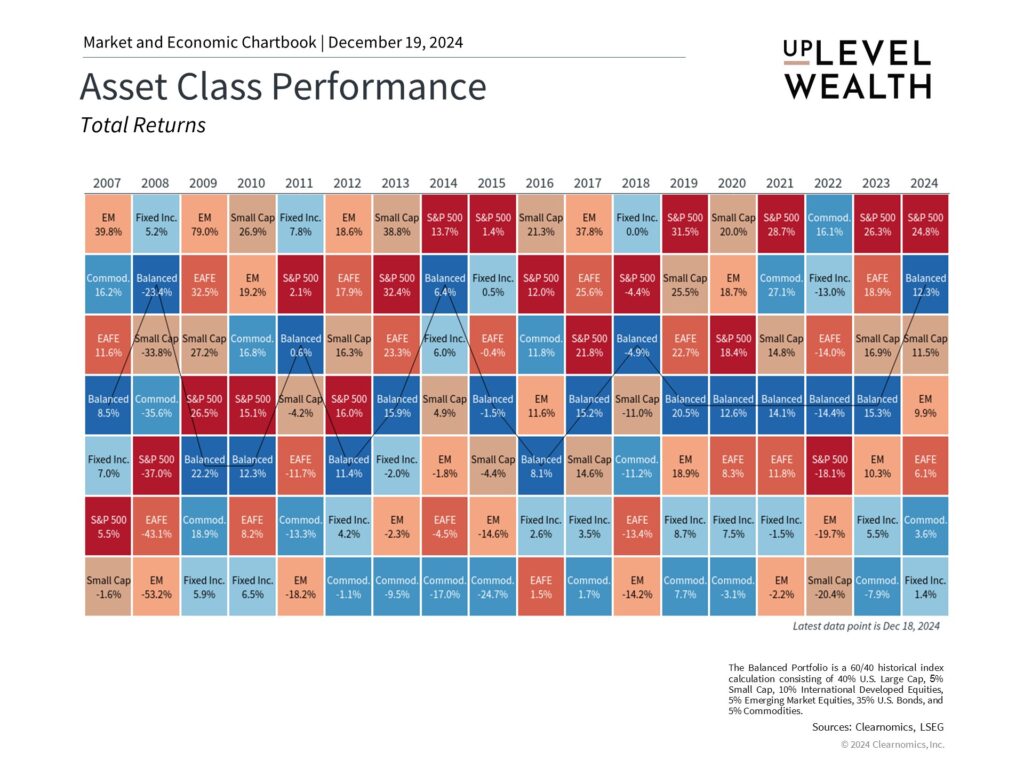

This good news has helped many investments grow in value. U.S. and international stocks, bonds, gold, and even digital currencies have all done well. However, we should remember that the economy faces some challenges, like high debt levels and potentially slower consumer spending. Assets that have risen sharply could experience greater volatility as well. In times like these, focusing on fundamentals such as earnings and valuations will be important.

2. Stock prices are high, so diversification is important

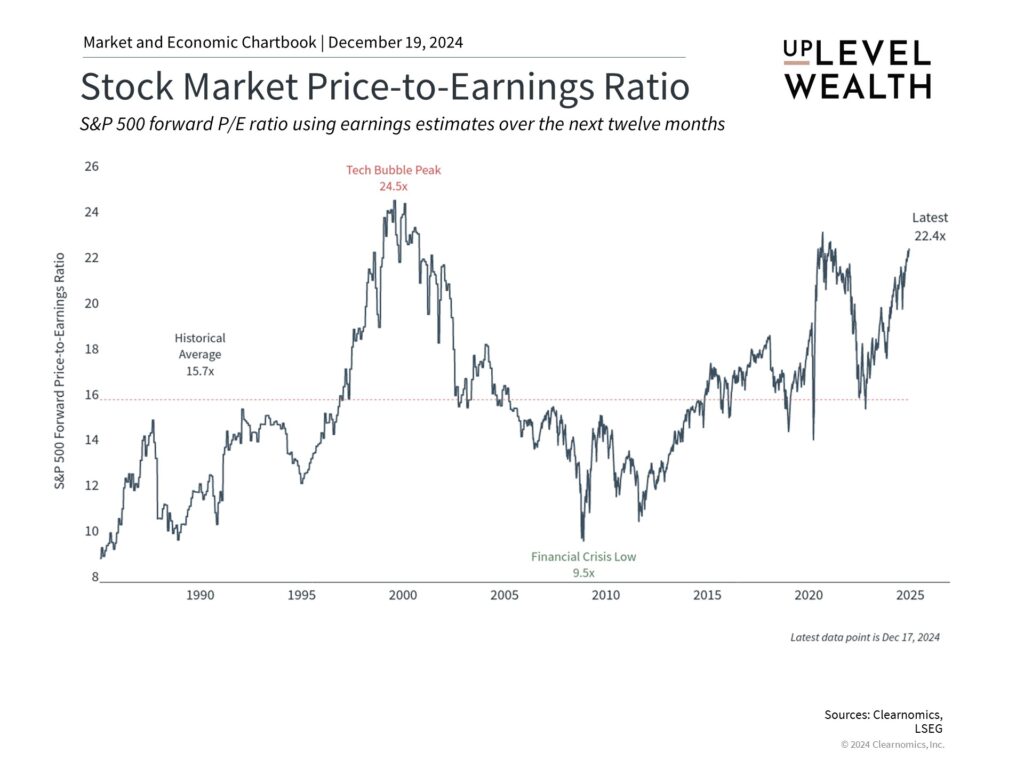

One reason for higher stock prices is the strength of corporate America. Corporate earnings have grown 8.6% over the past twelve months, rising to $236 per share for the S&P 500.

However, the fact that the stock market has risen far more than earnings means that valuations have increased. The price-to-earnings ratio is 22.4, meaning that investors are paying $22.40 today for every dollar of future earnings. This is well above the historical average of 15.7, and is nearing the historic peak of 24.5 during the dot-com bubble.

Valuations matter because paying a higher price today means, all else equal, a lower return in the future. For investors, this has two implications. First, it’s important to construct portfolios by balancing stocks with other asset classes such as bonds and international investments. Second, with stock market indices at historically expensive levels, it’s critical to focus on more attractive parts of the markets.

For example, while artificial intelligence stocks have driven market returns over the past two years, many other parts of the market have performed well recently. Year to date, all eleven sectors have generated positive gains. Given that it is difficult to predict which sectors may outperform each year, having an appropriate allocation to many parts of the market can help to stabilize portfolios.

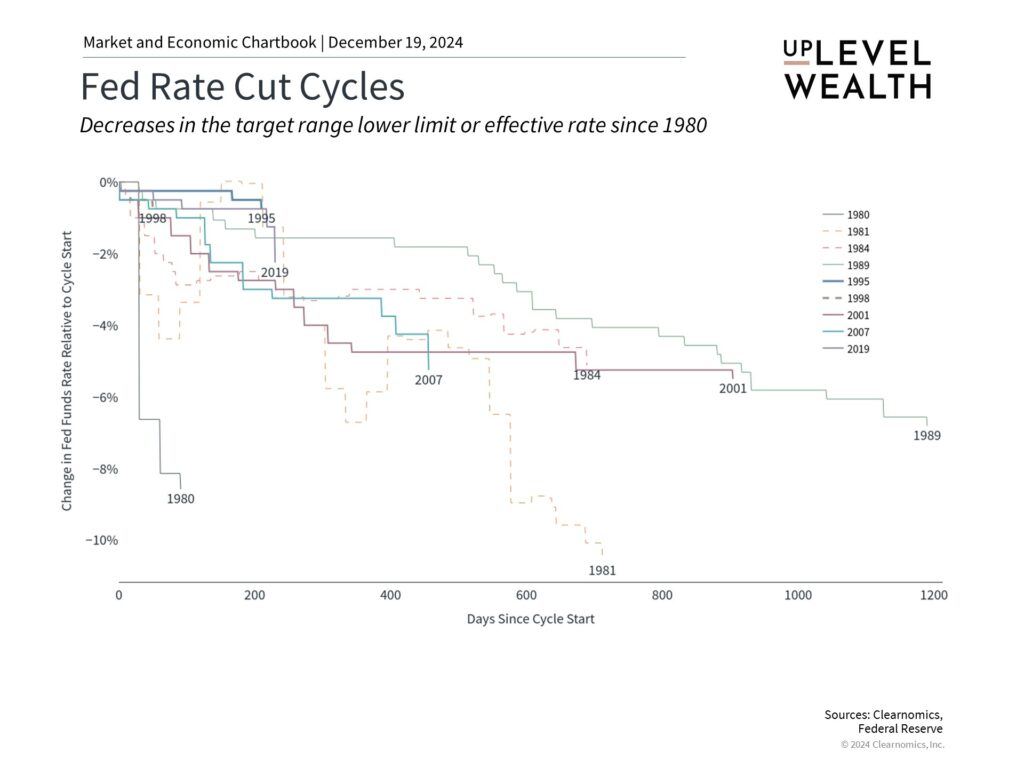

3. Interest rates are coming down

The Federal Reserve has started lowering interest rates, and more cuts are expected in 2025. Lower rates typically help both the economy and investments grow. This could be good news for both stocks and bonds, though the exact timing of rate cuts is uncertain.

The Federal Reserve has started lowering interest rates, and more cuts are expected in 2025. Lower rates typically help both the economy and investments grow. This could be good news for both stocks and bonds, though the exact timing of rate cuts is uncertain.

For investors, what matters is not trying to guess each move by the Fed, but the overall path of rates. With greater clarity and guidance around Fed policy, the market’s attention may shift back to specific policies by the incoming Trump administration.

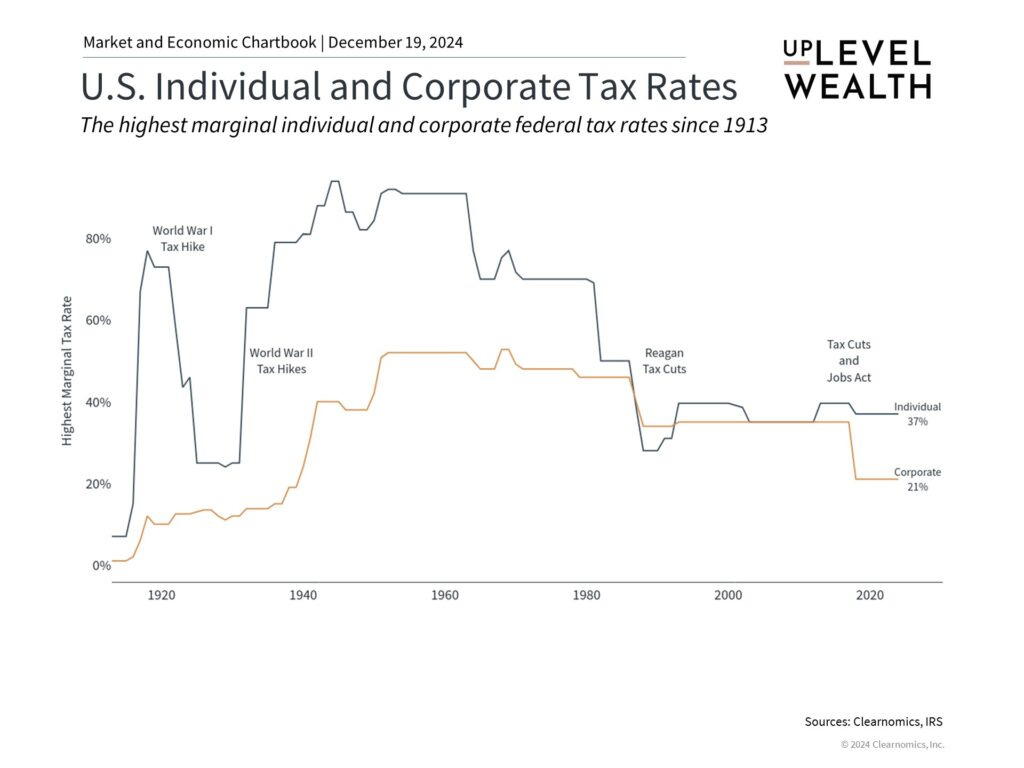

4. Focus on your plan, not politics

With the presidential election over, attention will shift to new policies. While politics can feel important for markets, history shows that both the economy and stocks can do well under either political party. What matters more is having a solid investment plan that fits your goals.

With the presidential election over, attention will shift to new policies. While politics can feel important for markets, history shows that both the economy and stocks can do well under either political party. What matters more is having a solid investment plan that fits your goals.

There are still concerns about trade relations and government debt, but these issues tend to work themselves out over time. The best approach is to stay focused on your long-term financial plans rather than reacting to political headlines.

5. Think long-term for the best results

The biggest lesson from 2024 is that markets can do well even when people are worried. While there were some scary moments during the year, staying invested paid off.

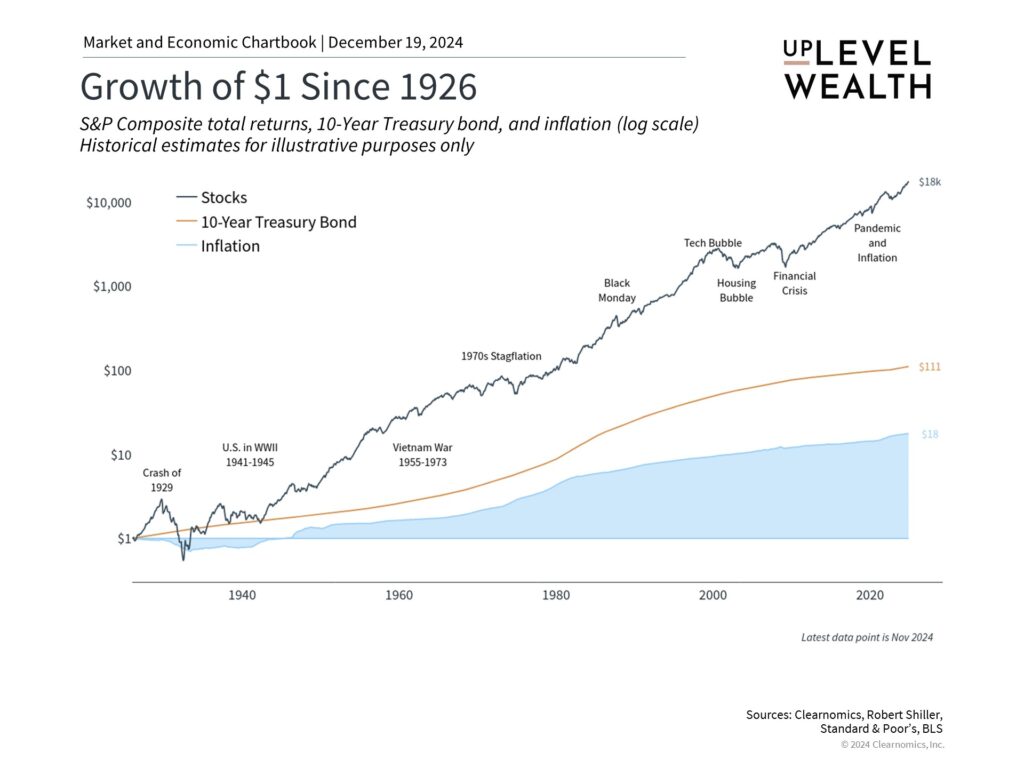

The accompanying chart shows the value of having a long-term perspective. History reveals that true wealth is created not over months, but over years and decades. Even for those already in retirement, having a longer-term perspective allows investors to put short-term events in context and make productive decisions.

The bottom line?

2024 was a strong year for investments despite many worries. For 2025, focus on having a balanced investment approach and staying patient through market ups and downs.

Unsure about your portfolio’s ability to weather the inevitable uncertainty that lies ahead? Reach out and schedule an introductory call. We’re here to help.

Uplevel Wealth is a fee-only, fiduciary wealth management firm serving clients in Portland, OR, and virtually throughout the U.S.